Terran Orbital’s ($LLAP) losses piled up despite progress on its monster $2.4B Rivada contract, the satellite bus manufacturer revealed Monday in its Q1 financial results.

By the numbers:

- Revenue of $28.2M, up 115% YoY

- Net income of -$54.4M, a 24% annual improvement

- Cash of $57.4M

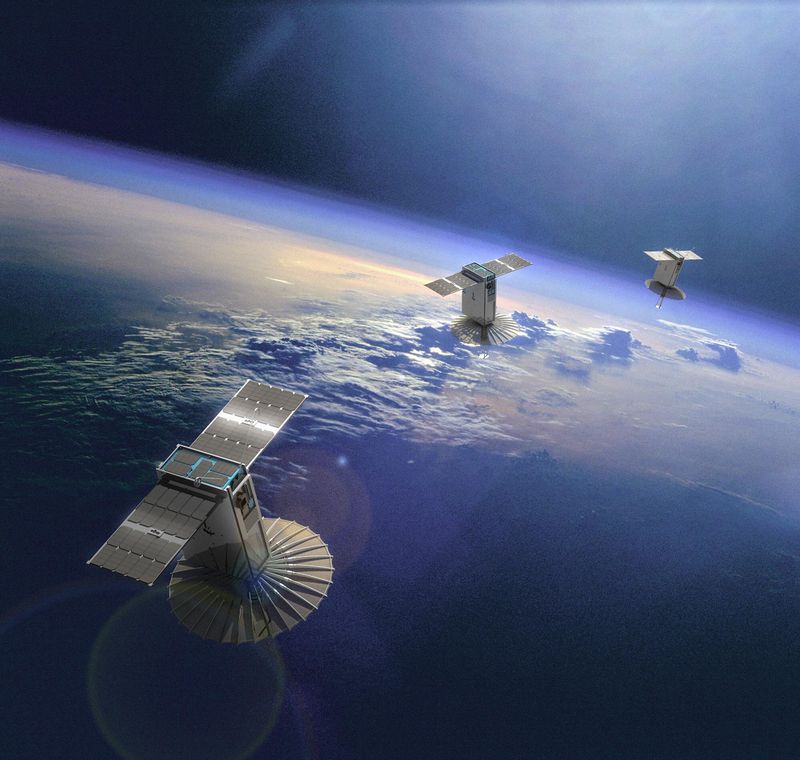

- Backlog of $2.5B and 360 satellites

Rivada’s three-year, 300 satellite contract accounts for the vast majority of the backlog. Terran received its first milestone payment from the contract last month as it inches closer to ramping up manufacturing.

Outlook: Terran expects the Rivada contract to begin paying dividends in the second half of the year. CEO Marc Bell said in a statement that the company’s newest expansion will come online in the next few weeks, with a capacity increase expected in Fall 2024. As a result, the company projects revenue to jump, driving an estimated $250M in total sales for 2023.

Cash: Heavy investment to meet the massive backlog has drained the company’s liquidity. Terran burned through $36.2M last quarter, leaving it with just $57.4M in its coffers.

- Management announced it will continue to explore raising additional funds in the capital markets to bridge the gap until the Rivada contract begins generating revenue.

+ Market reaction: As of market close Monday, $LLAP traded down 17.7%.