A seasoned A&D prime strike again.

Lockheed Martin ($LMT) announced last week it is acquiring Terran Orbital ($LLAP), its key SDA satellite bus supplier.

Terran has become a de facto extension of Lockheed over the past few years. And now, for pennies on the dollar ($0.25 per share to be exact, down 98% from its peak), the $450M deal which includes retiring existing debt, will officially consolidate the relationship.

Lockheed—an experienced aerospace prime with roots going back nearly 100 years and dozens of cycles under its belt—played a shrewd, successful, and unforgiving long game with its Terran relationship.

For Lockheed, the company gets to tuck in Terran’s $300M+ backlog (91% of which are its own contracts [!]) and a new manufacturing facility build-out well equipped to continue servicing its booming SDA business.

For Terran, the company was saved at the very last moment from an impending cash crunch. But it was at the expense of shareholders who lost nearly all of their value paying for the expensive production ramp to serve its dominant customer, Lockheed.

Terran Orbital 🤝 Lockheed

In 2020, Lockheed Martin won its first SDA contract, a $187.5M deal to build 10 satellites.

Not wanting to go through the headache, costs, and risk of standing up their own SDA small sat manufacturing facility, Lockheed outsourced the task to Terran Orbital and contracted with them for all SDA bus manufacturing needs. Classic prime.

Seeing billions of dollars worth of SDA contracts on the horizon, Lockheed decided to further interlock the relationship with Terran by contributing equity to its 2022 IPO. Over time the defense contractor built up a 30% equity stake.

Clear eyes, full heart, can’t lose: The customer/ownership relationship enabled Lockheed to share the risks and costs of scaling satellite bus manufacturing with external investors.

- If Terran boomed, Lockheed would win.

- If Terran went bust, Lockheed could achieve vertical integration the easy way: acquire an operational manufacturing plant after the majority of the hard work is done, with outside investors having helped fund the build-out.

Dreams of 1K birds: Leading up to the IPO, Terran Orbital was wide-eyed about the small sat industry, touting plans to build a 660,000 sq-foot facility in Florida that could build *checks notes* 1,000 satellites annually.

But by the time its shares began trading, the SPAC bubble was in the midst of a collapse, and forecasts of a space economy that could support all that supply were quickly debunked. Within a couple of months, the company lost 80% of its market capitalization.

Terran was forced to scrap plans for the mega facility build and pivot to a more targeted Irvine, CA facility expansion project which would support its largest customer, Lockheed. The aerospace prime was winning Space Development Agency contracts hand over fist and was gladly willing to pitch in $100M in the project to avoid doing it themselves.

That’s a lot of dough: SDA and its planned PWSA secure comms and missile tracking constellation is a massive revenue opportunity for Lockheed. To date, Lockheed has won a total of $2.6B worth of contracts for 106 SDA satellites, including:

- August 2020: 10 satellites; $188M

- February 2022: 42 satellites; $700M

- August 2023: 36 satellites; $816M

- January 2024: 18 satellites; $890M

Positioned in LEO, the constellation will require continuous satellite replenishment, providing a consistent revenue stream.

De facto arm: As time went on, prospects of non-Lockheed customers continued to dry up and it became increasingly clear that Terran was operating as an extension of Lockheed with the defense contractor accounting for 70% of Terran’s revenue and 91% of its backlog.

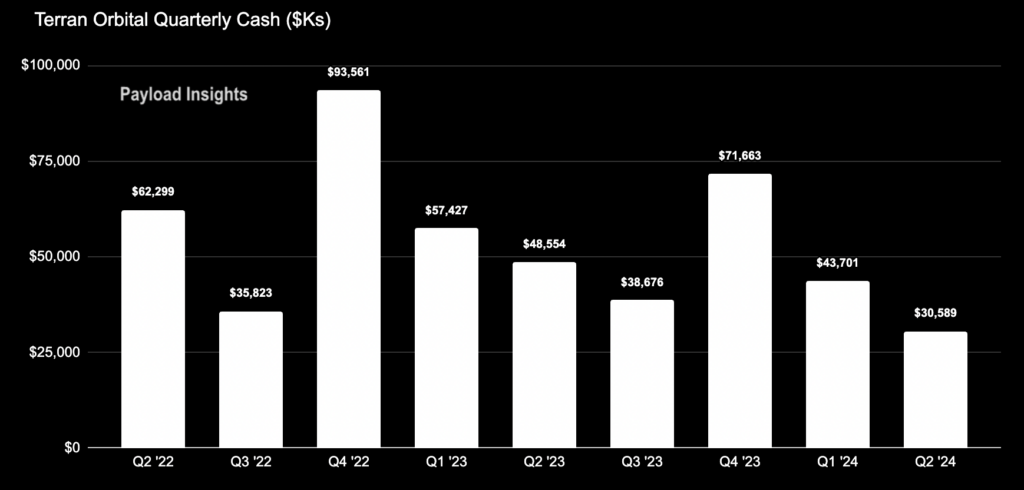

With Terran invested heavily in ramping up Lockheed production, the company’s cash and stock price declined further.

With only $14.6M of cash at the end of July, Lockheed saw that Terran was heading toward a bust.

In the end, with nearly all the equity wiped out and the company facing a cash crunch, Lockheed finally swooped in and scooped up its de facto SDA bus manufacturing arm for a manageable price.

Tortoise and the hare: Lockheed played the long game. They allowed Terran’s business to mature, waited for its heavy capex days to be behind it, and then tucked in a new manufacturing facility experience supporting in Lockheed’s 100+ satellite $2.6B SDA business. The transaction will result in millions of dollars worth of synergies.

- As a bonus, a day after the acquisition announcement, the SDA awarded Terran Orbital a $254M contract to build 10 satellites as a prime contractor.

Yes, Lockheed supported Terran along the way, but other equity/public investors did as well. Many of those investors, including retail shareholders, lost their shirts, with the stock closing down 98% from its peak.

A tale as old as time: Why build a satellite manufacturing facility, which is all too often fraught with delays and cost overruns, when you can buy it?

Lockheed’s $450M acquisition of Terran Orbital follows a similar playbook to its competitors, Boeing and Raytheon (RTX): acquire a small sat manufacturer rather than build one in-house.

- In 2020, RTX bought small sat manufacturer Blue Canyon Technologies for $426M

- And before that, in 2018, Boeing acquired Millennium Space Systems for an undisclosed price. At roughly 200 employees, Millennium was a similar size as Blue Canyon.

~$400M for satellite manufacturers seems to be the magic number for those clever ole primes.