The EO industry has done the fundraising, the satellite building, the launching. Now, it’s time to focus on actually using—and selling—the data that’s being collected in space, according to industry officials.

“I think the rubber is really going to meet the road,” Umbra COO Todd Master told Payload. “A lot of interesting tech got put into space. The question now is what of that data actually is needed by customers—that customers are willing to pay for?”

Tech to observe Earth from space was once solely the purview of the government, and commercial entry into the sector was widely seen as a threat. Over time, that perception has begun to shift, with both national security organizations and commercial customers buying imagery from private firms.

Planet can now image Earth’s entire land mass every day. Maxar Intelligence launched its fifth and sixth next-generation WorldView Legion sats last month, boosting the company’s ability to collect 30-cm resolution images. And the industry is going beyond traditional optical imagery from LEO—Umbra signed an agreement with the NGA last week to share its SAR data and Albedo raised $35M in January to build its constellation in VLEO, the first sat of which launched this month on Transporter-13.

EO providers have proven they can raise money, build high-resolution constellations, and collect data. The next big hurdle is figuring out what more can be done to make their businesses profitable.

“There’s this baton passing between getting mass on orbit and doing missions with that mass,” Peter Wilczynski, the Maxar Intelligence CPO, told Payload. “This is a make or break moment where, if you think about the financing that’s gone into EO over the last…10 years, I don’t think we’re going to get another real shot to get that level of financing in the next decade unless we’re able to really show that there’s a really robust commercial model.”

Payload talked with senior officials from HawkEye 360, ICEYE US, Maxar Intelligence, Planet, Umbra, Albedo, Wyvern, and Capella about the state of the EO industry and how companies are driving toward profitability.

The AI Revolution

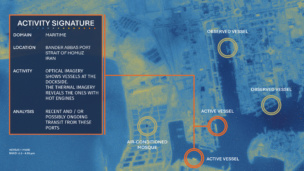

AI is poised to revolutionize the industry, according to multiple officials. Today, EO imagery is evaluated by people to spot vehicles of interest, detect changes in before and after pictures, and determine which imagery could be valuable to decision makers. It’s an even more laborious task for non-optical imaging, which must be assessed by experts with specific training.

AI and machine learning, however, can shorten the delivery of results from months to minutes.

“As people realize they can use a dataset, and don’t need to have gone to school in GIS to use it, that will accelerate adoption of EO,” said Ashley Johnson, Planet’s CFO. “AI is really accelerating the pace of analysts getting value from large quantities of data, and it enables non-GIS analysts to interface with GIS tools. You don’t need years of training to get started.”

However, that doesn’t mean AI adoption by the EO sector is without its challenges. The models will need to be trained on an enormous dataset. And for some use cases, that training can be complicated.

While nearly anybody can help train models to spot cars or which pixels of an image have cloud cover, no one can sit at a computer and train a model on which pixels of an image have a certain nitrogen level in a leaf, according to Wyvern CEO Chris Robinson. To do that, experts need to actually go out into the field and get a clipping of the leaf on the day the image is taken to help label the data—data which may not be applicable across seasons or locations.

“If you want to get into stuff that I think will bring true ROI to end users, at least in hyperspectral, it will require a lot more work than people think,” Robinson said. “[AI] is the latest buzzword, and it is a useful tool that I think will have a lot of great uses in EO…but don’t think it will turn EO into a silver bullet.”

Customer Base

The top customer for the EO industry continues to be national security and intelligence agencies. As commercial EO tech improves, some officials predicted that industry could take on more missions that used to be reserved for high-value government assets, freeing up the national security and intelligence communities to shift their focus to high-stakes, kinetic missions.

“A lot of people thought commercial is the way to go. That still may be true in the long run, but in the short term, defense and intel has a much better idea what to do with the data,” said Patrick Zeitouni, the chief strategy officer at HawkEye 360.

And it’s not just the US government. Foreign governments have seen the usefulness of EO data, especially in the lead-up to the war in Ukraine where imagery from space showed the world the build-up of Russian troops on the border. Countries have tapped EO companies to build them sovereign constellations, ensuring they are not relying on other nations for data in times of conflict.

There’s been a number of high-dollar contracts in this realm this year, including Maxar’s $14M deal to grant the Netherlands Ministry of Defense the ability to task its sats and access its data and Planet’s $230M contract to build a LEO constellation for Japan’s SKY Perfect JSAT.

“They wanted to know that the source of truth was effectively their own analytics as opposed to relying on intelligence agencies,” Johnson said.

But US firms face some difficulty selling overseas due to export control restrictions. American SAR providers can export 300 MHz sensors, which produces slant resolution imagery roughly equal to a 50-cm resolution. The government is trying to loosen the rules, by increasing approval to 500 MHz, but two top American SAR providers publicly pushed back against that benchmark last year, saying that anything below 1,200 MHz is not commercially relevant.

“System costs have come down, so for countries who previously couldn’t have thought about buying a constellation, it’s now affordable,” said Master. “From a US perspective, SAR is covered by ITAR….We can only export a system that’s effectively two generations old from state of the art, so non-US companies can provide systems to sovereign customers in a much more advantageous way.”

What about non-governmental customers? Some leaders predict there’s lots of room for growth.

“There is vast potential for improving access to unique datasets like SAR across commercial forestry, mining, oil spill detection, infrastructure monitoring, supply chain management, economic indicators, illegal fishing and more,” Capella CEO Frank Backes said in a statement. “The challenge is translating that research into practical solutions that can lower the barriers to adoption for non-experts.”

In some cases, EO companies need to make the case to customers that space can do what drones or helicopters are already doing for them in an easier, better, or cheaper way, said Albedo’s CEO Topher Haddad.

More broadly, Wilczynski said the industry needs to look at priorities in the economy, such as construction, urban change and development, and large scale infrastructure investments and then pitch to customers on how EO can answer their questions better than existing tech. But he warned—”I don’t think there is any low hanging fruit.”

One Stop Shop

There’s no one EO specialty that is poised to win the industry. High resolution, rapid revisit, hyperspectral, and SAR all serve a purpose and can answer different questions, including being able to see in incredible detail, quickly spot changes, detect qualities undetectable to the human eye, and maintain eyes in the sky overnight or through cloudy weather.

“We’re not really seeing any multiphenomenology fusion,” Master said. “There’s a huge opportunity here, since each phenomenology gives you a unique set of information.”

Many officials said the next potential area of growth for the industry is figuring out how to combine multiple data sets to more efficiently answer customers‘ questions—though there are multiple proposals on the best way to do that.

- Planet is building a platform that would enable customers to combine multiple data sets, including the company’s imagery archive, publicly-available data, and even the customer’s own proprietary information, Johnson said.

- ICEYE’s CEO Eric Jensen imagines a future where people build mission-specific products that would buy and aggregate data from multiple sources—such as a wildfire detection platform that includes everything a customer needs without having to individually source the data.

What’s Next

The biggest challenge for the EO industry, however, could be figuring out its next big-picture milestone that will inspire the younger space workforce.

“Industries are always in a strange place when they achieve their mission,” Wilczynski said. “We did it. We mapped the world….The big challenge for the EO industry is what is the vision you’re fighting for next? The motivating factor that will bring in the next generation of people?…The big challenge for the EO world is what are we trying to achieve?”

Correction: This article has been updated to correct Todd Master’s role at Umbra. He is the COO.