Hockeystick SPAC charts. Wallstreetbets Reddit page buzz. Short squeezes. Everything to the Moon euphoria.

2024 was a throwback year for space stocks, with some valuations soaring by triple digits—clawing back gains lost during the 2022 and 2023 SPAC implosion.

The gains coincided with a broader stock market rally this year, driven by solid economic growth, chilled-out inflation, increasing likelihood of a soft landing, and the prospects of a Trump pro-business agenda.

Space stocks aren’t just rising due to broad investor sentiment; there are also key underlying tailwinds propelling SPAC growth, including the potential for deregulation, an increasing focus on space as a national security domain, shifting government procurement strategies, and improving business fundamentals:

- AST SpaceMobile: On May 15, the company announced a commercial agreement with AT&T to provide direct-to-cell connectivity as an opt-in service. Two weeks later, on May 29, AST announced that it was teaming up with Verizon. The company also launched its first five commercial birds in September.

- Rocket Lab: The company continues to smash its revenue records this year, including pulling in $105M of Q3 sales, a 55% YoY increase. Its space system segment is leading the charge recording 73% of sales YTD, and Neutron development is progressing toward a potential 2025 launch.

- Intuitive Machines: In September, the company won a monster NASA contract worth up to $4.8B.

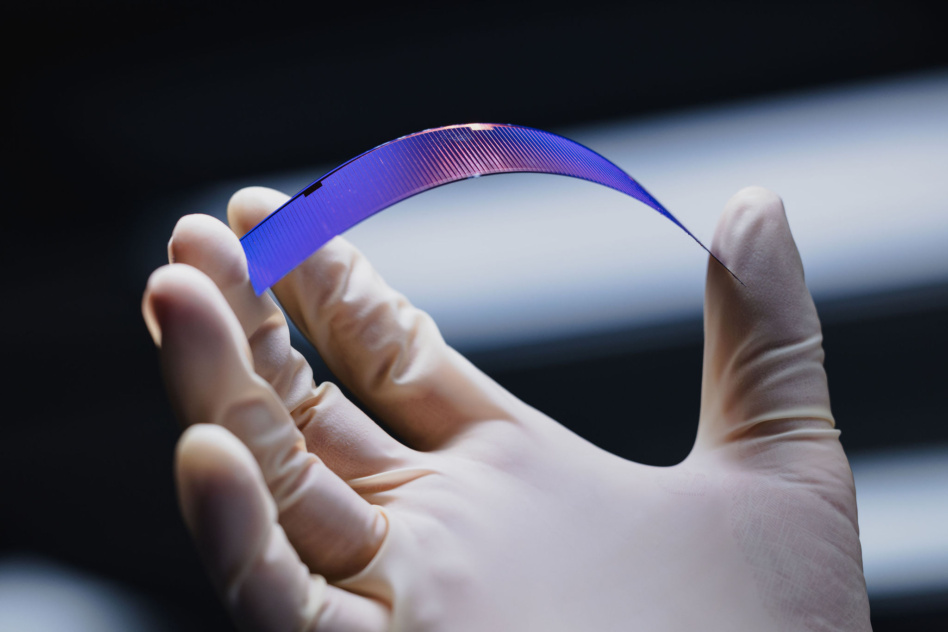

- Redwire: The company has positioned itself as a key supplier to the industry, nabbing several contracts this year, including a deal with Thales Alenia Space to build Roll-Out Solar Array (ROSA) wings.

Cash is King: 2023 vs. 2024

Despite a jump in valuations year over year, space businesses remain cash-burning machines.

Viasat, Planet, and Globalstar were the only companies to meaningfully improve quarterly burn rate through the first three quarters of the year. Planet laid off 17% of its workforce this summer as it focuses on reaching profitability.

Meanwhile, companies undertaking significant R&D endeavors, like Rocket Lab with Neutron, AST SpaceMobile with its BlueBird constellation, and Virgin Galactic with its Delta spaceship, continue to burn, burn, burn.

Cash burns, but cash improves: Despite the burn rate, cash on hand and implied quarterly run-rate have improved this year as companies turned to rebounding capital market appetites to bolster coffers. As a result, none of the publicly traded space businesses on the list face an imminent liquidity crisis next year.

Has Quarterly Burn Improved During 2024?

Looking at just the most recent quarter (Q3 2024) burn versus the 2024 average, Viasat, Planet, Globalstar, and Iridium are again the only companies to show meaningful improvement throughout the year. Cash burn for Rocket Lab, Telesat, and Redwire grew in Q3.

Final thoughts: Space businesses often require years of heavy R&D investment before they turn cash flow positive. After a constellation is deployed or a rocket is operational, companies can elect to take a CAPEX holidays and start generating cash as Iridium is currently doing, and Rocket Lab plans to do after Neutron is operational.

However, slowing CAPEX in the name of prioritizing free cash flow risks falling behind competitors. Catch-22.

(Jake Morrissey contributed research to this article)