Fortuna Investments is opening a Miami office with the goal of investing in 12 early-stage space startups over the next few years.

“I think it’s an incredible time to get involved and allocate capital,” Fortuna founder and CEO Justus Parmar told Payload. “We have a lot of powder dry and are looking for opportunities.”

Fortuna 101: The VC firm was founded in 2015 and counts over 30 employees. Fortuna, which Parmar primarily funds himself, has invested in over 125 startups, focusing on emerging industries such as robotics, life sciences, and lithium mining.

Now Fortuna is turning its attention and investing experience to space.

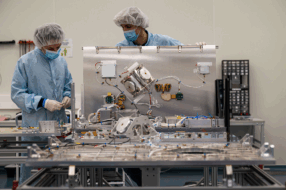

Toes wet: Fortuna’s first investment was in Starfighters Space, a company with a fleet of seven F-104 supersonic aircrafts. Starfighters is building out suborbital air-launch capabilities to pair with its pilot training and Mach-2 testing businesses.

- Fortuna led a $10M round in Starfighters, which included additional funds from friends and investors.

NFL to space: Earlier this month, Fortuna appointed NFL alum Frostee Rucker as VP of the West Coast office and Starfighters board member. Rucker will leverage his 13 years of NFL experience to help with deal origination, investment decisions, and to bring in investors and communities that have historically been underrepresented in the space ecosystem.

“The space industry is a niche group of people,” Rucker told Payload. “There’s a lot of communities that have been left out, and now I feel like I could be a key to the growth of the sector.”

Fortuna’s space investing thesis

Parmar opened up to Payload about Fortuna’s space investing thesis and market outlook:

- Tailwinds: Strong industry drivers include IoT connectivity, Space Force budgets, and competition with China.

- Headwinds: Space is a nascent industry with generally under-developed tech, which sets up a difficult investment environment against the backdrop of high interest rates.

- Market opportunity: There’s a huge opportunity to support high cash-burn businesses struggling to secure funding in the high interest rate environment.

- SPACs: Failed SPACs have left a lot of institutional and retail investors believing space is uninvestable. This could present additional opportunities.

- VC investing: Risk is high in VC investing, but the returns are outsized. Fortuna’s goal is to support the ecosystem and get a couple winners.

“We know we are in the winter, but after winter comes spring,” said Parmar. “The greatest companies the world has ever seen have come out of very difficult markets.”