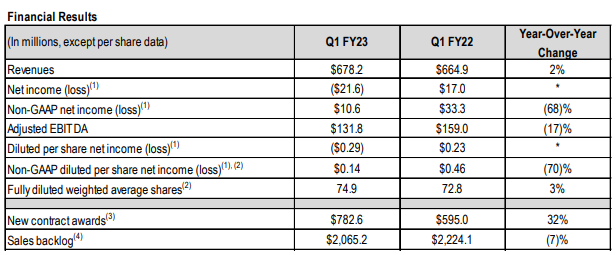

Viasat ($VSAT) kicked off another busy week of space earnings after the bell Monday. The satellite operator reported Q1 FY23 revenues of $678M (+2% YoY), with a GAAP net loss of $22M (vs. $17M of net income last year).

- Viasat reported total consolidated awards of $783M (+32%YoY) for the quarter, good for a book-to-bill ratio of 1.2x and a backlog of $2.1B. (Book-to-bill = the ratio of orders received to amount shipped/billed over a given period.)

Highlights: Viasat’s “satellite services” segment achieved record quarterly revenue of $312M (+14% YoY), driven by strong commercial in-flight connectivity (IFC) sales.

- IFC: Viasat ended June with 1,900 aircraft in service. A key customer win was Southwest Airlines, which inked a deal for IFC services on all new jets, starting this fall.

- M&A: “We are also well positioned to fund the closing of the Inmarsat acquisition,” Viasat wrote to shareholders Monday.

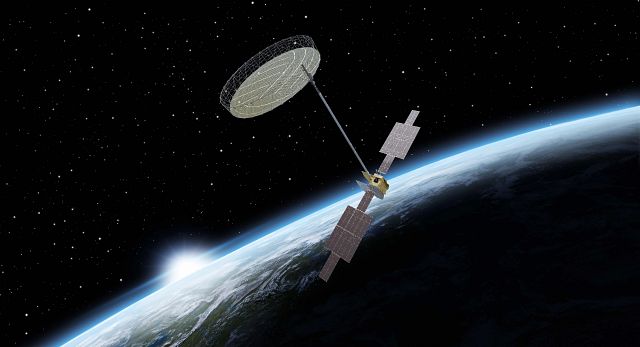

Lowlights: OpEx dragged on earnings due in part to ground segment build-out ahead of the ViaSat-3 launch (which has slipped but is on track to launch later this year). Other unfavorable factors included “market entry and support costs,” along with higher sales and marketing spend.

The ViaSat-3 fleet: Each ~6.4-ton beast is expected to bring unprecedented download speeds (100’s of Mbps), 1-Terabit/second (tbps) of capacity, and service that can be dynamically reapportioned to high-demand areas across the globe. The three-satellite GEO fleet, in Viasat’s telling, is expected to “provide the best bandwidth economics in the industry.”

Needless to say, the launch of the first ViaSat-3 will be a pivotal moment for the company and a generational update 22,236 miles above Earth. Viasat said last week that it’s begun mechanical integration of ViaSat-3 Americas, attaching solar arrays, reflectors, and other accessories from the spacecraft wardrobe. Once that’s done, the satellite will be fully configured for launch for the first time.