Deloitte released its SpaceTech report this morning, which reviews the most active and quickly-growing segments within the space industry. The report is intended for readers who are leaders in their own industries but remain in the dark about the progress that’s been made in space over the last decade.

“In previous decades, a thoughtfully developed tech strategy became a competitive imperative; similarly, over the coming decades, companies across all industries will increasingly need to consider whether a space strategy will be a key component of their future,” the authors wrote.

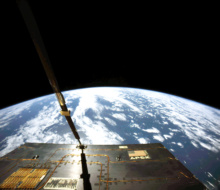

To compile their analysis, the writers interviewed space industry officials and organized their takeaways into “regions”: here on Earth, nearby in orbit, and out there in the rest of the universe.

Here: Starting down on Earth, access to space has increased dramatically in recent years. The boom in commercial launch drove down the cost to send spacecraft to orbit, and rideshare capabilities (Thanks, SpaceX) gave smaller companies with less capital on hand the ability to launch missions of their own.

This “as-a-service business model is transforming space launch in the same way that the cloud democratized IT: making it increasingly accessible, responsive, and affordable,” the authors wrote.

Near: The number of satellites in Earth orbit is shooting up exponentially. Active satellites in orbit increased 44% in 2022 to almost 7,000, with ~3,800 in LEO, Deloitte found. It expects that by 2030, the number of LEO sats will hit 40,000.

That’s a lot of room for growth. The areas poised to take the most advantage, per Deloitte:

- Satcom. 80% of satellites deployed between Jan. 2020 and April 2022 were communications satellites.

- Navigation. Deloitte projects the market for global navigation satellite services will grow to $547B by 2031, up from $220B in 2021.

- Earth observation. It’s currently just ~10% of the space economy, but EO’s role in a slew of other industries sets its prospects for growth high, from ~$3B now to $8B in 2030 and $25B in 2040, according to Deloitte’s predictions.

There: The space industry is, relatively speaking, new, and space companies have hardly scratched the surface of everything that’s possible to achieve out there. The possibilities for human spaceflight are immense, Deloitte writes, including the potential for habitation on other celestial bodies and longer-term visits in orbit. The analysts also pointed to asteroid mining as a potential revenue stream down the line, though we’re far from seeing that become a reality.