Traditional Ground Station as a Service (GSaaS) providers will soon face competition from relay communications networks that promise faster transmitting, simplified licensing, and potentially lower cost.

While relay networks require high throughput to be cost-effective, the increasing demand for space-based data suggests the service is ripe for adoption.

Ground station landscape

Ground station service 101: After a satellite captures data in space, the operator must transmit it to a ground station on Earth for processing. However, building ground stations is a large capital-intensive project, and the high upfront investment often does not make economic sense for a company building a small fleet of satellites.

The GSaaS industry—there’s an acronym for everything nowadays—has taken off over the last decade to solve that inefficiency problem. GSaaS allows satellite operators to buy time in existing ground stations and pay on a per-minute or per-pass basis. So, when a satellite passes over an in-network ground station, it can simply beam down the data to a third party ground station and pay the service cost.

- GSaaS services providers include AWS, Azure, KSAT, Viasat, Leaf, RBC, and ATLAS

- The service offers economies of scale from the first minute by fully utilizing a ground station’s capacity.

- Rates generally start at ~$3 per minute in S- and X-band frequencies.

By removing the high upfront cost, GSaaS has played a crucial role in the growth of the LEO startup ecosystem. But while GSaaS has made the market more efficient, there are limits to the service.

Get in line: GSaaS providers can only collect data from a satellite when it is overhead—which is not a problem for GEO birds but can create scheduling challenges for LEO birds that are only in the line of sight for a couple of minutes every orbit. If a station reaches its capacity, operators have to wait for the next available station availability. It can take multiple passes to complete a data downlink.

Licensing: Each satellite system must be licensed with each ground station location, often limiting operators to a few locations.

Full capacity: Economies of scale peak when antennas reach their full capacity. The primary way to reduce the per-gigabyte downlink cost is by packing more data per minute, which often requires changing a satellite’s hardware.

Enter in-space relay networks

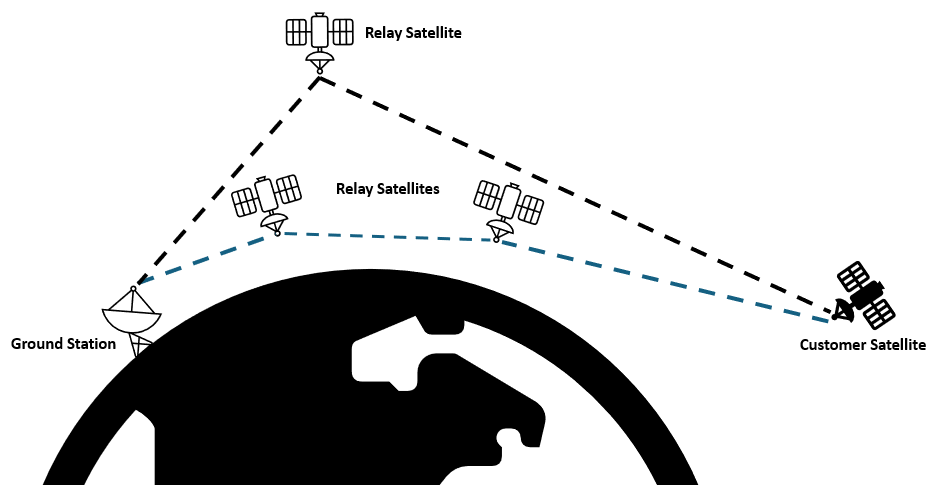

While traditional ground stations can only communicate with satellites for a few minutes when overhead, in-space satellite relay networks can instantaneously send data between satellites and the ground via higher altitude satellite or inter-satellite optical or RF link networks.

Continuous access to ground stations increases transmission efficiency as it eliminates the mad dash to downlink data.

Benefits of In-Space Relays:

- Instantaneous: Data can be transferred to the ground immediately without waiting for the next available ground stations, allowing operators to get their hands on data faster.

- High data rate link: Relay systems can aggregate multiple lower-data-rate S-band links from satellites into a single Ka-band high-data-rate link to increase efficiency or leverage laser links to connect with satellites.

- Simplified licensing: Relay systems may reduce the number of ground stations a satellite needs to connect with, which reduces regulatory complexity. Additionally, no additional licensing is required for optical links.

Who’s building relay networks?

NASA has been operating its own in-space relay network for years to facilitate communications with its Tracking and Data Relay Satellite system (TDRS). As NASA prepares to retire the TDRS network, the agency awarded $279M worth of contracts for in-space relay demonstrations, paving the way for a new generation of commercial systems.

The NASA contracts include funding for SpaceX, Kuiper, Inmarsat, SES, Telesat, and Viasat.

- Optical vs RF links: SpaceX and Kuiper have developed relay capability by leveraging optical links, with the rest sticking with traditional RF links.

- Demonstrations: Planet Labs and Loft Orbital perform data relay demonstrations through the SES and Viasat communications systems.

Hybrid approach: The awardees take a hybrid approach, utilizing their satellite communications networks to connect third-party satellites and terrestrial users. Since relay networks require high data traffic to become cost-effective, the hybrid approach allows satcom providers that service terrestrial users to bring additional revenues by offering communications services to third-party satellites.

Dedicated relay network: While most of the satcom industry focuses on hybrid systems, Kepler Communications is building a dedicated relay system that leverages optical links for inter-satellite and ground communications.

Fueled by the retirement of NASA’s TDRS, the maturity of optical communications, and the increased need for real-time communications as private space stations come online, Kepler believes it can successfully build the first dedicated high-throughput relay system.

Advantages of Kepler’s dedicated system

- Optimized for coverage of LEO orbits

- Open protocol, allowing users to seamlessly roam between ground stations and relays

- The architecture is designed for both RF and optical downlinking capability

However, dedicated relay networks have a history of failures, with Audacy and SpaceLink being two recent examples. Both systems arrived ahead of their time in a still-developing LEO market and early advancement in satellite communications.

The cost question: The benefits of instantaneous in-space comms relays are well understood. The one big question is cost. Service cost has always been a constraint for relay networks due to the need for high data traffic to become cost-effective.

The rise of hybrid systems and the growth of the space market alongside advancements in communication technologies might finally make in-space relays cost-effective, rivaling traditional GSaaS providers.

The story has been updated to include further context on Kepler’s downlinking capability.