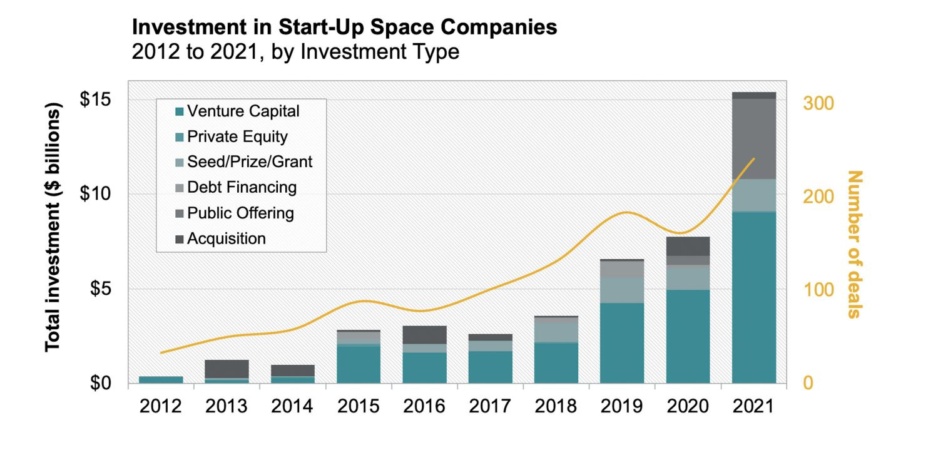

BryceTech has released its 2022 report on the state of space startups. 2021 saw record levels of investment and a record-breaking number of deals funneling into space tech.

By the numbers:

- The startup space sector saw $9B in venture capital investment, an 82% increase YoY.

- There were 120 total VC deals, up 52% YoY.

- Overall, $15.4B in financing funneled into the space sector in 2021, vastly overshadowing the previous record of $7.7B in 2020.

- 241 startup space deals were made in 2021, with 596 investors backing 212 companies and a $64M average check size.

The rush of VC funding wasn’t limited to the space sector. Last year was a huge year of investment in general, fueled by low interest rates. VCs invested $330B across all industries in 2021, nearly doubling 2020 investment levels.

A SPAC-sized Elephant in the Room

$9B of the ~$15B total financing into the space sector came from VCs. The majority of the remainder came from the flurry of SPAC offerings in 2021. We followed 11 space companies that went public via SPAC in 2021: AST SpaceMobile, Redwire Space, Momentus, Spire, Planet, ArQit, BlackSky, Virgin Orbit, Rocket Lab, Telesat, and Astra. A handful of others made their de-SPAC announcements last year to be completed in 2022. One SPAC target, Tomorrow.io, called the transaction off, citing “market conditions” and a desire to remain private.

While SPACs help companies raise capital quickly, it subjects them to the volatility of the public markets. Space SPACs are down 35% on average, BryceTech reports.

- The SEC has said it plans to crack down on overzealous SPAC projections. New companies hoping to come to market via SPAC may need to temper their expectations.

The forecast

Looking bright, but with some caveats. “To sustain levels of investment seen in 2021, space start-ups will need to assuage investor concerns related to unproven business models, uncertain customer bases, and the lengthy time horizons needed to achieve profitability,” per the report.

Translation: Investors expect returns. If that doesn’t happen, it could have a chiling knock-on effect on financing available to private space companies of all sizes. In the coming years, BryceTech analysts expect a shift from development and deployment fueled by investment to “business-supported operations.”