Yesterday, Eutelsat confirmed Bloomberg reporting that it is officially in talks to merge with OneWeb.

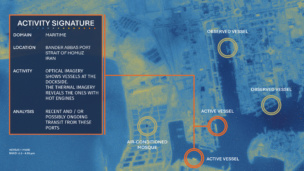

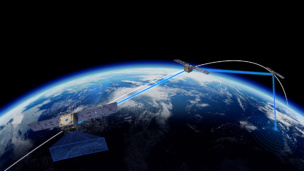

Refresher: OneWeb is building a LEO broadband megaconstellation to rival the likes of Starlink and Kuiper. The UK company has launched 428 satellites (~66% of its planned constellation). France’s Eutelsat, founded in 1977, operates a fleet of 36 GEO satellites that provide broadcast and broadband services across the globe.

The two have signed an MoU that would see them join forces to provide integrated multi-orbit broadband service.

The race to multi-orbit: OneWeb and Eutelsat would join a handful of companies planning to launch multi-orbit service, primarily driven by M&A. Viasat ($VSAT), the American GEO operator, is nearing a takeover of Inmarsat, while Eutelsat competitor SES currently operates satellites in both GEO and MEO.

- This also isn’t OneWeb’s first shot at a multi-orbit merger. Intelsat and OneWeb announced a plan to merge in 2017, but the deal fell through four months later.

M&A rationale: Combining LEO and GEO services would allow operators to leverage the higher capacity and reliability afforded by GEO and LEO’s lower latency.

Merger details

Sources told the FT that Eutelsat is looking for growth prospects since satellite video demand is in secular decline. OneWeb, meanwhile, has a capex problem: It needs $2B-$3B in fresh financing to carry out its ambitious plans.

- With OneWeb poised to become a key provider in the competitive, cash-intensive LEO broadband market, and with Eutelsat averaging $700M in free cash flow over the past five years, the deal ticks the boxes for both companies.

The all-share transaction would value OneWeb at $3.4B and create a new company, with ownership split 50/50 between the two companies’ current shareholders.

- The UK currently owns ~20% of OneWeb after investing $500M (£416M) in 2020 to resuscitate it from bankruptcy.

- French and Chinese sovereign funds own 20% and 5%, respectively, of Eutelsat.

- OneWeb’s largest shareholder, Bharti Global, owns 30%–and is itself owned by Indian billionaire Sunil Bharti Mittal. Eutelsat is OneWeb’s second largest shareholder, with a 23% stake.

Too many cooks? The merger would bring a potpourri of public and private players together in ownership of the new conglomerate (or require divestitures). France and the UK would get ~10% stakes and one board seat apiece, while Bharti would own ~18% of the new company and become co-chair of the board, per the FT.

- The UK has already won concessions, sources told the Guardian, like veto power over moving a future HQ out of the UK and the right to mandate the new entity’s take on certain government contracts.

Not so fast…This is not a done deal and talks could still fall through. Even if an agreement is ironed out, the companies would have plenty of regulatory, antitrust, and cap table hoops to jump through. Credit Suisse said the deal is “likely to be scrutinized heavily” from a competition lens, given British UK concerns about outsized foreign influence in its space sector.

+ How’d the market react? Not great; Eutelsat’s stock fell 17% Monday.