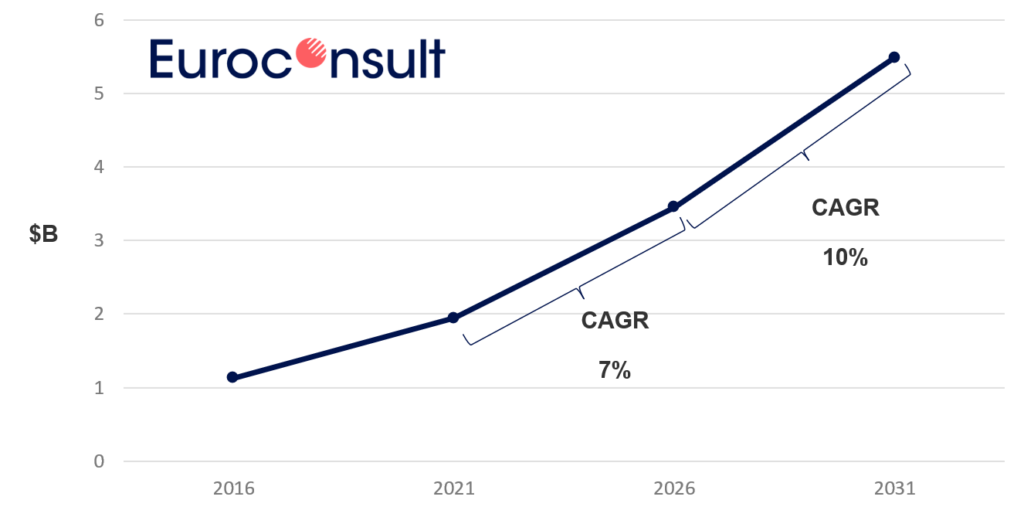

Gone are the days of switching off your phone and laptop before takeoff and living a lonely, analog life until landing. The in-flight connectivity (IFC) industry has seen rapid growth over the past year, and the number of connected airplanes is expected to double within the next decade, per a new Euroconsult report on the topic.

Tuning in: The IFC industry saw a lot of growth over the past year, and that growth is expected to continue over the coming decade.

The state of IFC, by the numbers:

- 9,900 commercial airplanes offered the service

- More than 120 airlines used IFC services on their flights

- Total bandwidth consumption capacity increased to 24 gigabytes per second

- By 2031, Euroconsult estimates that 21,000 commercial airplanes will provide connectivity—more than double the current number

- If IFC reaches 2031 predicted levels, that’s ~58% market penetration.

Bouncing back: The pandemic—and related border closings and travel restrictions—affected the IFC market. Euroconsult estimated in its 2021 report that the industry lost $970M over the previous year.

Last year, the firm provided both optimistic and pessimistic predictions for the IFC industry, depending on whether the airline industry could bounce back from COVID. Turns out it did, and this year the firm opted to go back to a single, optimistic prediction. (If that’s not a vote of confidence, we don’t know what is.)

The growth, Euroconsult writes, can be partially attributed to the slew of mergers and restructuring in providers that occurred during the pandemic. These companies emerged ready to sign new contracts, and so they did: 1,500 new aircraft were signed on to be equipped with IFC capabilities during 2021.

Ripe for growth: The past months have seen a handful of IFC deals among major players in satellite broadband.

- Viasat inked a deal with Southwest in May to provide connectivity on all its new planes starting this fall—an announcement that featured prominently in Viasat’s recent earnings report. The company has a similar deal with Virgin Atlantic, and is providing connectivity from GEO to a number of other airlines.

- OneWeb signed a deal with GoGo Business Aviation, also in May, to provide its airplanes with connectivity from LEO.

- Starlink is also in the IFC game, with JSX and Hawaiian Airlines each opting to adopt SpaceX’s LEO service on their jets.

The upshot: More and more airlines are becoming interested in offering IFC on their flights, and the M&A environment is making those deals easier. Euroconsult is expecting to see more IFC offerings in the years to come.