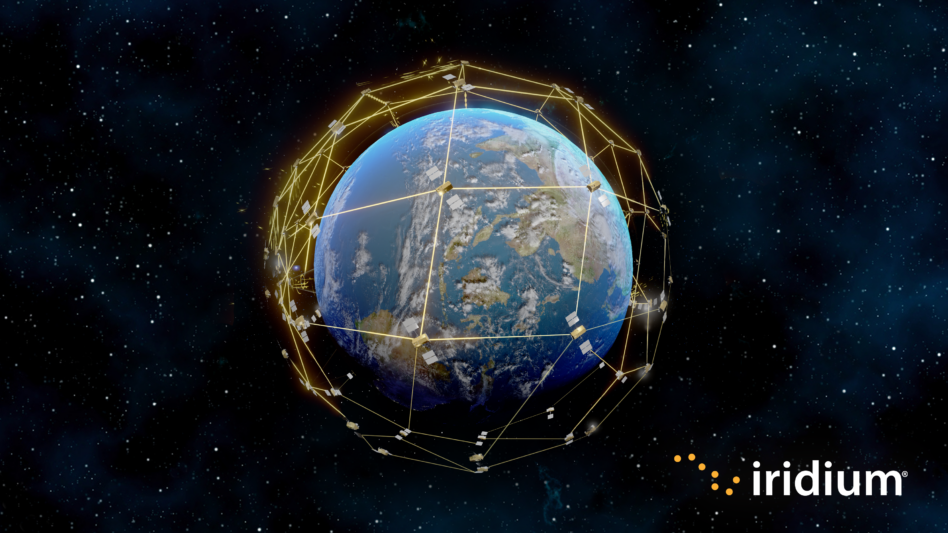

Iridium ($IRDM) was doing 2020s-era space stuff before it was cool. The McLean, VA company deployed a constellation in low-Earth orbit and used those satellites to provide connectivity to devices in hard-to-reach areas around the world. It went bankrupt once upon a time, and in 2009 it went public via SPAC.

Now, Iridium appears to be reaping the dividends of patience and a strategic decision to stay in its lane. The company reported strong growth for its specialty broadband services through the first half of 2022. Across that stretch, Iridium has handily outperformed space peers and major indices, despite broader market headwinds.

Q2 in brief

On Tuesday, Iridium reported quarterly revenue of $174.9M, a 17% YoY increase, and $4.6M in net income.

- Service revenue came in at ~$133M (76% of overall Q2 sales).

- Sales of equipment, engineering, and support projects totaled $42M.

- Government service sales were $26.5M (+3% YoY).

- Iridium ended Q2 with 1.875M total billable subscribers (+16% YoY), driven by strong commercial Internet of Things (IoT) sales.

“2022 is shaping up to be a blockbuster year for Iridium, as demand for equipment and new subscriber activations drove record revenue growth in [Q2],” Iridium CEO Matt Desch said Tuesday.

Iridium guided to 7%–9% service revenue growth for 2022, versus its previous guidance of 5%–7%. Analyst Case Taylor noted on Twitter:

Where can you find Iridium?

The company sells finished products, like satcom phones, but also licenses its technology to other equipment manufacturers. Iridium’s partner network of ~500 companies helps the company diversify channel sales and ultimately connect more machines. Iridium’s technology can be found in everything from maritime vessels to large link-belt excavators to small chipsets.

“We were architected many years ago to be extremely efficient at bringing data, which could be voice but also other types of data, to very, very small portable mobile devices, starting with a satellite handset,” Desch told Payload in March. “We’ve scaled down even from there to where we can boil what we do down [to] the size of a dime.”

Further miniaturization is the order of the day. Iridium intends to go smaller, “getting sewn into the uniform of a soldier, being tacked onto a backpack on a hiking trip, or being put [into somebody’s] pocket,” Desch told us back in March.

Smartphones?

In March, Desch said Iridium’s network “was built perfectly” for a satellite interface being integrated into a smartphone…

…and lo and behold, Iridium says it’s working with an unnamed company to enable Iridium service in smartphones. The company anticipates wrapping up technology development and negotiating a service provider agreement by year’s end.

+ $IRDM pulse check: Iridium traded up 6.2% on Tuesday and the stock is up 13.3% in July. Year to date, Iridium is up 2.4%, healthily outperforming the Nasdaq (-27%).