On Friday morning, the markets woke up to quite a surprise: A PE firm was taking Maxar ($MAXR) private in a mega-deal worth $6.4B. Then, we saw a monster merger confirmed Sunday evening, with L3Harris ($LHX) agreeing to buy Aerojet Rocketdyne ($AJRD).

$MAXR take-private

Maxar’s board voted unanimously to enter into a definitive merger agreement with Advent International, a Boston-based private equity group with $89B AUM. It’s one of the largest leveraged buyouts (LBOs) in the last few months.

Deal terms: Advent will purchase all outstanding shares of common stock for $53/share, a 129% premium over Maxar’s closing price on Dec. 15. The deal includes a 60-day “go-shop” period that ends on the last minute of Valentine’s Day. During those 60 days, Maxar management can solicit takeover bids from other third parties. In the unlikely scenario a better deal is found, then Maxar has the option to nix the Advent arrangement and take the other offer.

The view from Westminster, CO: Since Advent is paying in cash, Maxar can shed its $2B+ debt load and focus on deploying its delayed, next-gen WorldView Legion constellation without the short-termism and scrutiny that comes with being public. Advent can also use Maxar as a platform investment, from which it can make bolt-on acquisitions with additional EO technologies, satellite operators, and collection capabilities.

$AJRD finds a new home

L3Harris will buy Aerojet at a purchase price of $58/share, implying a transaction value of $4.7B (including debt). Aerojet makes liquid- and solid-fueled propulsion products for major space players and missile makers. Its key space programs include the SLS’s RS-25 engines, the Orion spacecraft’s main engine, the RL-10, and in-space electric propulsion products.

Multiple bidders had been interested in the El Segundo, CA company.

- Earlier this year, the FTC blocked a $4.4B takeover bid from Lockheed Martin ($LMT), saying the merger could inflate the cost of rocket engines for other contractors or even lock out their access to the supplier.

- A few weeks ago, Reuters reported that US industrial conglomerate GE was in the running to acquire Aerojet.

- Aerojet also faced boardroom drama in recent months.

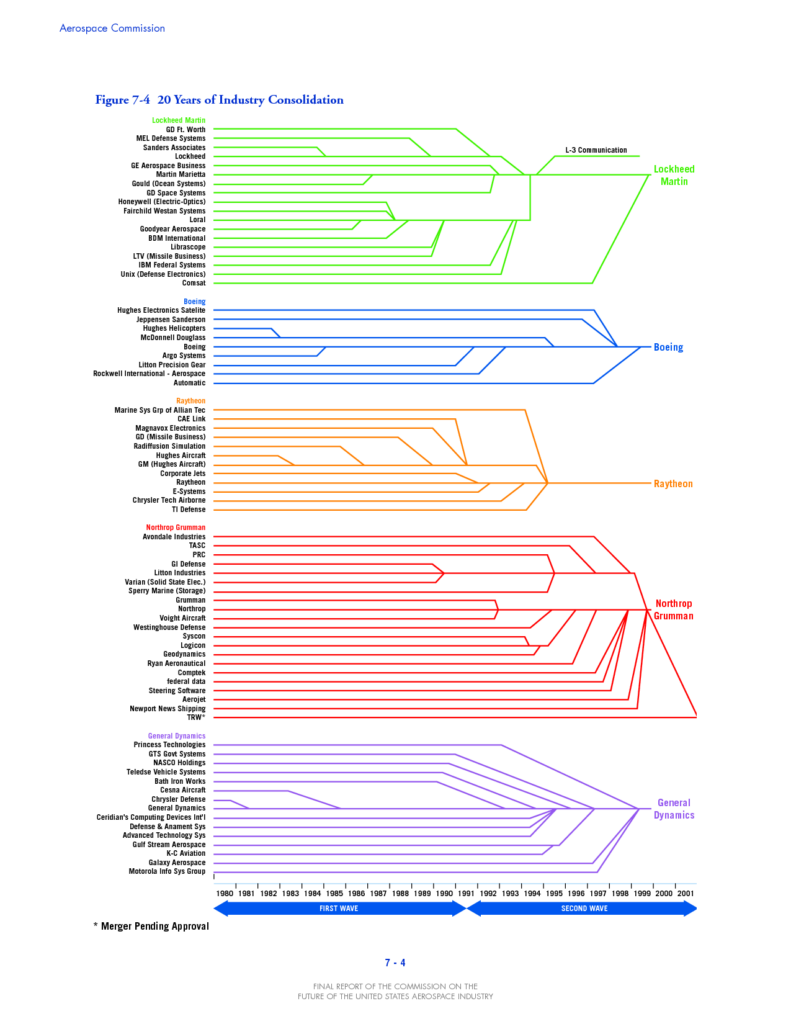

Historical backdrop: While L3Harris and Aerojet were quick to tout the deal as a win for the competitive landscape, the US defense industrial base has seen decades of consolidation.

One example? In 1950, the US had five major solid rocket motor producers. By the 2010s, there were just two: Orbital ATK and Aerojet Rocketdyne. Orbital ATK was snapped up by Northrop Grumman ($NOC) in 2018, and by mid-2023, it seems that Aerojet Rocketdyne will be part of L3Harris.

Key #s, at a glance: Aerojet made nearly $2.2B in 2021. In a Dec. 18 deck, the company said it expects that number to grow to $2.5B in 2024. It has 5,000+ employees, ~30% of which are engineers, and touts 14 “strategically placed facilities” across the country.

+ Stock pulse check: Shares of $AJRD were up 2% in premarket trading, while $LHX was off by 1.7%.