Ed. note: This is Payload Research analysis. You can sign up for our Research newsletter here.

Last week, we covered ABL, Relativity, and Stoke funding, three launch startups that have yet to reach orbit. This week, we are focusing on a business that has hit its orbit proof point, Firefly Aerospace.

Firefly’s small launch Alpha rocket sits squarely within the responsive launch market, but the company is building out its product portfolio to include medium-lift capabilities in the economic launch market, orbital transfer vehicles, and lunar landers. The approach positions the company as an end-to-end space transportation business and not just a pure-play small launch provider.

Funding History

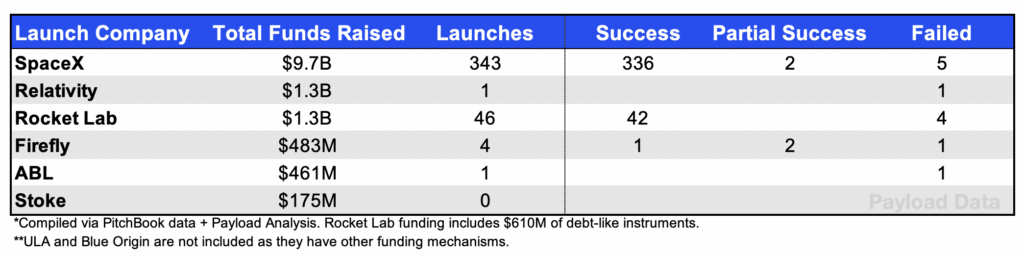

Firefly has raised $483M since 2017, according to PitchBook data. The company closed a $300M Series C round last year. The round was led by AE Industrial Partners with participation from Abbey Road, Partners, Mitsui, Mango.vc, and Global Alternative Investment Management.

Firefly’s history:

In 2017, Firefly Aerospace formed from the bankruptcy of Firefly Space Systems, a rocket and space-tech startup.

- The new management team reorganized the business and adjusted the tech roadmap, but were able to leverage an existing manufacturing facility and some pre-existing development.

- Notably, the pre-2017 work head start is not included in the funding chart above.

- Post bankruptcy, Firefly’s funding is in line with ABL Space Systems and 60% less than Relativity Space.

The funding thus far has resulted in four Alpha launches, a small-lift launch vehicle capable of lifting 1,030 kg of payload to LEO. The launch outcomes have been a mixed bag: one full success, two partial successes, and one failure.

- As discussed last week: 47% of maiden launches suffer a significant anomaly, according to ESA chief Josef Aschbacher. SpaceX’s first rocket, the Falcon 1, failed to reach orbit on its first three launches. New rockets needing a handful of attempts to reach consistent performance is almost expected in the rocket game.

Launch, Land, and Orbit

Firefly is casting its net wide, betting that the most sustainable space transportation model is one with diverse and end-to-end offerings. The company’s product roadmap includes:

- Small responsive launch (Alpha)

- Medium economic launch (Antares 330/MLV)

- Lunar landers (Blue Ghost)

- Orbital transfer vehicles tugs (Elytra)

Firefly’s non-launch products drive a meaningful portion of company-wide development costs, investor interest, and valuations. Launch is difficult to scale to profitability alone. But owning the capability provides access to a broader market.

- It is a similar—but slightly different—-approach that SpaceX employs. SpaceX has launched over 340 times, with reusability driving healthy gross margins; however, it has only recently begun squeaking out a profit. The company is now looking to Starlink to drive significant cash flow.

Alpha rocket: The 1,030 kg of payload to LEO Alpha vehicle falls within the responsive launch category. Last year, the rocket successfully launched the Victus Nox mission for the Space Force, deploying a defense payload with just 24 hour notice.

Firefly said at the beginning of the year that it aims to launch Alpha four times this year and six to eight times in 2025. However, given the company’s current cadence, we expect the company to launch 2-3 times this year.

MLV / Antares 330: In addition to responsive launch, the company is also positioning itself to compete in the economic launch market. Firefly has formed a strategic partnership with Northrop Grumman to develop the Antares 330 and Medium Launch Vehicle (MLV) rockets, which will be capable of transporting 16,000 kg to LEO.

The development will occur in two phases.

The first phase involves building a first stage for the existing Antares 330 vehicle, where Firefly supplies the engines and develops the first-stage booster. Northrop will provide the second stage and avionics. This vehicle is slated to launch for the first time in 2025.

The second phase involves constructing an entirely new second stage and brand new launch vehicle named MLV (we hope there’s a better name in store here). Firefly will eventually incorporate reusability into the next-gen vehicle.

The reason for the phased approach is driven by Northrop’s desire to continue executing on its NASA CRS missions as soon as possible (as a result of the engine supply chain issues for Antares, Northrop has needed to fly its Cygnus spacecraft on SpaceX rockets…ooph!)

The partnership with Northrop represents a shrewd approach to diversifying risk, sharing costs, finding synergies, and leveraging flight heritage. The more conservative strategy contrasts with the in-house everything model that most other launch startups have adopted. But it is a choice that has been welcomed by investors, as rocket development is a capital-intensive process with no guarantees.

Elytra: Firefly announced its Elytra orbital transfer vehicle last year. The spacecraft—which is set to debut this year—is designed to provide varied access for last-mile transportation, life-extending servicing, and debris deorbiting.

Blue Ghost: Lastly, Firefly is developing a lunar lander for the NASA Commercial Lunar Payload Services program, dubbed Blue Ghost. The company has secured ~$230M in NASA contracts to build two Blue Ghost landers, each capable of transporting ~150 kg of payload to the lunar surface. The first lander is slated to launch later this year.

A Look at Valuations

Firefly’s four Alpha launches and progress on its Medium Launch Vehicle, Blue Ghost, and Elytra have landed the startup a $1.75B valuation.

How does that valuation compare to its peers?

Firefly’s valuation is $600M lower than ABL Space Systems and $1.5B lower than Relativity —two comps that have yet to achieve an orbital proof point, let alone expand into other product categories.

Does that imply that Firefly is undervalued? Not necessarily.

If we compare Firefly’s valuation to that of Rocket Lab, we can see an alternative angle. Rocket Lab is meaningfully ahead of Firefly in launch cadence and in other revenue streams, yet its market cap also sits at $1.8B. Furthermore, Rocket Lab is also positioning its business to drive significant revenue outside of launch. The company’s space systems division, which includes designing and manufacturing spacecraft and components, accounts for roughly two-thirds of its revenue.

One plausible explanation is that Rocket Lab’s valuation is depressed as investors may see the company’s Electron launch vehicle as economically uninteresting, with a subpar margin profile. In that case, Rocket Lab’s medium-lift launch vehicle, Neutron, will be the next major catalyst for the company.

Intuitive Machines is another comp to consider when looking at Firefly’s lunar lander subdivision.

- Intuitive Machines recently became the first commercial spacecraft to land on the Moon.

- The company has two more NASA CLPS contracts and is developing other cislunar tech, including a lunar terrain vehicle.

- As a publicly traded company, its market cap sits at $650M.

Intuitive Machines’ valuation provides some insights into how valuing Firefly’s lander division, but it also raises questions. NASA CLPS contracts are ultra-low-cost contracts (generally in the $100M range with suppliers responsible for buying their launch), and they are almost certainly driving negative margins for the first batch of contracts.

It is also possible that Intuitive Machines’ valuation is influenced in part by its retail investor attraction, and so its $650M market cap may make for a poor comp when looking to value Firefly’s lander division.

Blue Ghost is a wager on the development of a lunar economy, anticipating significant cargo transfers to and from the moon—a bet that may take a decade to realize.