On Monday morning, El Segundo, CA-based Aerojet Rocketdyne ($AJRD) reported Q2 net income of $16.4M. Aerojet develops liquid- and solid-fueled propulsion products for major space players and missile makers.

The propulsion provider missed on top- and bottom-line expectations, with quarterly earnings coming in at $0.20 per share (vs. $0.47 est. and -66% YoY). The company posted Q2 revenues of $528.5M (-5.1% YoY). For the first six months of 2022, Aerojet reported $1.04B in sales (-1% YoY).

Net income dropped by ~64% YoY. Management attributed the decrease in net income to:

- “Cost growth from supply chain disruptions” and technical/manufacturing tweaks to its standard missile program

- “Favorable contract performance on the RS-68 program in the prior year”

- $16M in costs incurred in Aerojet’s recent proxy battle (more on that in a moment)

The backstory: a scuttled deal and a house divided

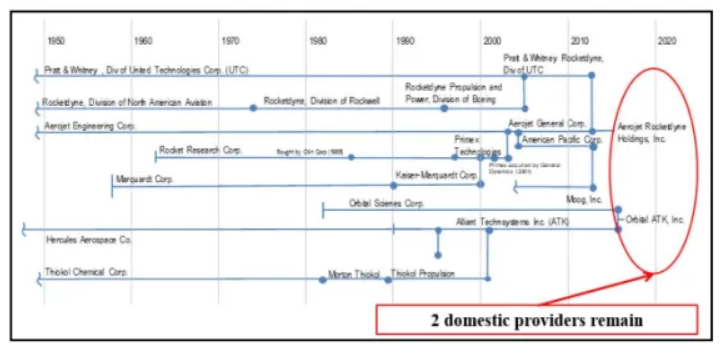

A deal falls through: US antitrust cops nixed Lockheed’s attempted $4.4B acquisition of Aerojet Rocketdyne ($AJRD) in February. At the time, FTC staff alleged the merger would let Lockheed boost the cost of rocket engines for other defense contractors, or even lock out their access to the supplier, and endanger national security. The FTC may be revisiting the Northrop/Orbital ATK deal for the very same reason.

Palace intrigue…In the wake of the scuttled Lockheed deal, Warren Lichtenstein, Aerojet’s executive chairman, kicked off a proxy battle against CEO Eileen Drake and her boardroom allies. Lichtenstein instigated what Drake’s camp called a “boardroom coup” and said the CEO failed to plan for a future in which Aerojet remained independent. On June 30, shareholders backed Drake, ousted Lichtenstein, and elected a new slate of directors that includes the CEO.

Looking forward…“Our business remains strong, as robust orders contributed to our quarter-end backlog of $6.9 billion, just shy of our highest backlog recently recorded and equal to approximately three times our annual sales,” said CEO Eileen Drake. The backlog includes a ULA award for 116 R10s, which will fly on the Vulcan in support of the Amazon Kuiper megaconstellation’s deployment.

+ Apropos of nothing, fun trivia fact: Aerojet started as the General Tire & Rubber Company in 1915.