2022 was the second largest year of ADG deal-making on record, according to a comprehensive analysis published Wednesday by market intelligence firm HigherGov. BTW…ADG = aerospace, defense, and government, and M&A = mergers and acquisitions. With this one simple trick—using ADG and M&A rather than writing the phrases out in full—we’ve given you seconds of your life back that have now been offset by this sentence.

While anyone interested in the financial dynamics of the ADG world should read HigherGov’s report in full, we’ve flexed our curatorial muscles and donned our finest armchair macroeconomist hats to break down the space takeaways below.

433 ADG transactions were announced in 2022, down 10% from 2021. While 123 deals were announced in Q1 and Q2, volume began to dip in the back half of the year. Q3 saw 105 deals, while Q4 saw just 81.

Move aside, VCs

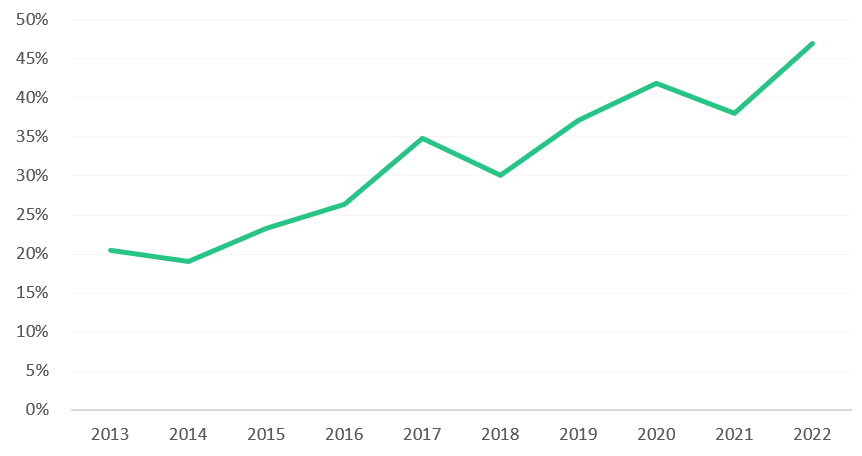

Below, see the share of ADG acquisitions made by private equity over the last nine years:

Private equity has become a force to be reckoned with in the ADG space.

PE shops now account for 47% of all transactions and 41% of deal value. In 2022, the number of completed transactions was 203, up from 182 in 2021, and nearly 90 private equity players were involved.

Smaller, strategic buyouts dominated the M&A landscape in 2022, per HigherGov:

- Acquisitions of companies with a sub-50 headcount increased from 250 to 282.

- A majority of the deals followed the “bolt-on” or “buy-and-build” playbook, whereby companies consolidate technology and talent under one roof. PE shops spearheaded 140 transactions in this category (vs. 103 in 2021).

- 2022 also saw 59 divestitures, compared to 51 in 2021.

In 2021, when interest rates were still low (or lower), private equity firms were “playing catch-up” on capital deployment goals, which partially explains why the year’s transaction volume was so high. As for 2022? We’re not in the business of betting here at Payload, but…if we were, we’d put our chips on private equity accounting for the lion’s share of ADG deals this year.

Space’s time to shine

“Space and cybersecurity, once niches in ADG, are now major pillars of the sector and transaction volume,” HigherGov founder Justin Siken writes. These were the largest ten announced ADG deals in 2022, with a total dollar value of $30.4B:

- Advent International’s $6.4B acquisition of Maxar Technologies

- Apollo, J.F. Lehman, and Hill City Capital $5.2B acquisition of Atlas Air Worldwide

- L3Harris $4.7B acquisition of Aerojet Rocketdyne

- Carlyle Group $4.2B acquisition of ManTech

- Eutelsat $3.4B acquisition of OneWeb

- The $2.1B combination of Vectrus and Vertex

- L3Harris $2B acquisition of the Viasat’s tactical data links business

- WSP Global $1.8B takeover of John Wood Group’s E&S biz

- Veritas Capital $1.6B acquisition of Chromalloy

- Singapore Airport Terminal Services $1.1B acquisition of Worldwide Flight Services

For those following along at home, that’s three of the top five deals involving companies with principal concerns above the Karman line.

Aerospace, Defense M&A

Space M&A was down year over year but still quite active in 2022, with 38 transactions completed. The year “was dominated” by geospatial, satcom, and propulsion deals. Below, you can see how space stacks up against other sectors:

The case for another bullish year of M&A

Here at Payload, we’ve written extensively on this topic over the last year. HigherGov’s Siken cites many of the same themes we’ve been thinking about:

- The war in Ukraine and subsequent boosts in Western defense budgets “may encourage a more consolidated and partnership-focused approach within the relatively fragmented European defense industry.”

- Many ADG contracts last multiple years and generate predictable cash flow, which commands investors’ interest during downturns.

- Looking ahead, although space sector activity may have reached a local maximum, deal-making will likely stay strong. Some companies will close up shop, unable to tap the capital markets, but most “will likely successfully weather an economic downturn,” Siken writes.

- The Pentagon has shown a strong interest in space, and even has marching orders from Congress to work more closely with the private sector.

- On the flipside, the Pentagon and other elements of the federal apparatus have concerns about the state of America’s defense industrial base and consolidation (see: the scuttled Lockheed-Aerojet deal). That could ice out bigger deals, Siken notes, but shouldn’t affect the middle market or startups.

The upshot for aerospace, defense, and government?

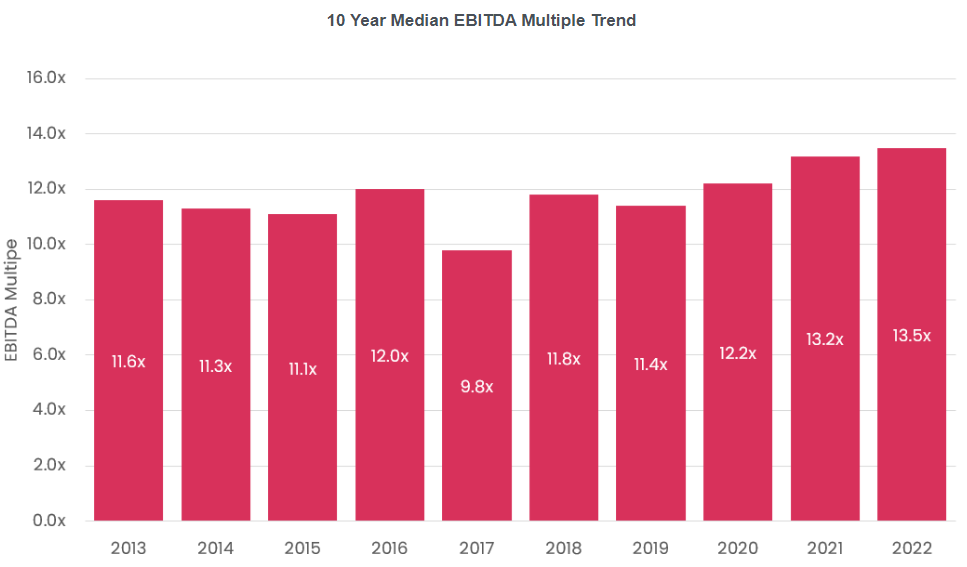

Valuation multiples are up. The median trailing 12-month EBITDA multiple for disclosed transaction multiples in 2022 was 13.5x, an all-time high:

Companies looking to sell—with a proven business model, stable cash flows, and the right fundamentals—can still be price makers rather than takers. “Strong demand from strategic buyers and private equity firms with significant dry powder” will carry over into 2023. And cash is king for buyers, given elevated rates and a high cost of capital.