Boeing ($BA) Q2 results fell short of Wall Street expectations yesterday, due to weaker defense sales and program delays. Robust commercial plane orders softened the blow, and the company stuck by its forecast to return to positive free cash flow this year.

The overall numbers:

- Operating cash flow = $100M

- Revenue = $16.7B, a 2% decrease year on year

- GAAP earnings per share = $0.32

- Core non-GAAP loss per share = $0.37

- Total backlog = $372B

Breaking out space:

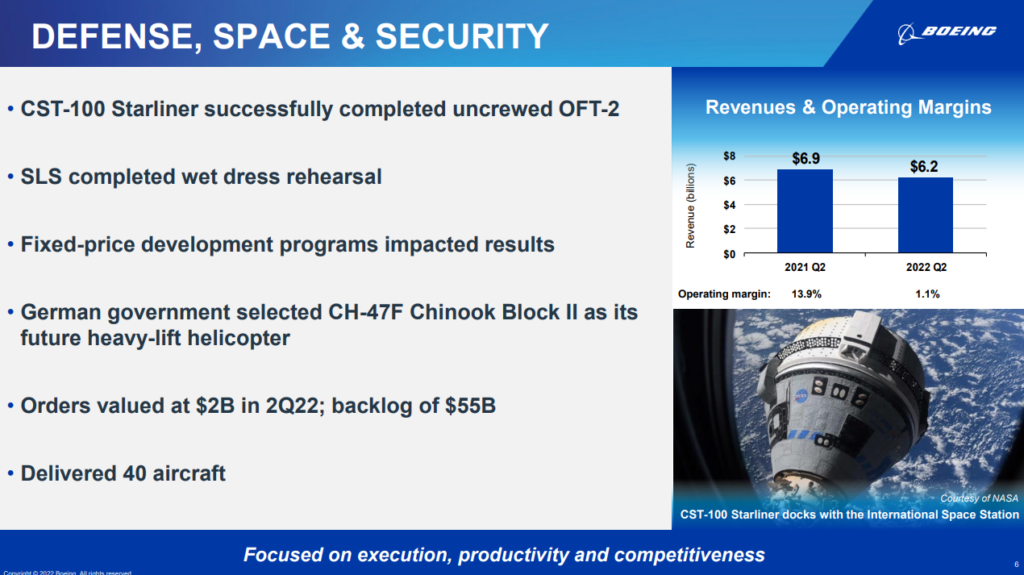

- Revenue = $6.2B, a 10% decrease year on year

- Total backlog = $55B (33% of which comes from non-US customers)

Boeing’s Defense, Space & Security division attributed the decline in revenue to changes in fixed-price programs, unfavorable performance on other programs, and lower demand for derivative aircraft.

But those weren’t the only issues weighing on the business unit…

Starliner’s development setbacks almost certainly contribute as well. Boeing took a $93M Q2 charge for Starliner development, bringing the program’s cost overruns to $688M.

- Meanwhile, the MQ-25 refueling drone program cost Boeing $147M in Q2.

Beyond financials, Boeing’s shining space highlights from Q2 were the successful test flight of Starliner and the SLS wet dress rehearsal. With the second uncrewed orbital flight test out of the way, the next step is a crewed mission. The first crewed test flight is scheduled for sometime in Q4.

Boeing’s stock price fell slightly after the markets opened yesterday but quickly recovered to around its 5-day average.

“As we begin to hit key milestones, we were able to generate positive operating cash flow this quarter and remain on track to achieve positive free cash flow for 2022. While we are making meaningful progress, we have more work ahead.” said Boeing CEO Dave Calhoun.